Up to $26,000 per Employee!

File your ERC Claim Today!

The Employee Retention Credit (ERC) was established under the Coronavirus Aid, Relief, and Economic Security (CARES) Act to provide employers with a valuable tax incentive. Designed to acknowledge the challenges faced by businesses throughout 2020 and 2021, the ERC offers a substantial reward to employers, regardless of their size, for retaining their workforce during these turbulent times. Given the significant disruptions experienced by businesses in the past year, this presents an excellent opportunity for them to obtain essential tax relief, providing some much-needed respite.

At the ERC Filing Center, we will take you through all the steps of claiming the ERC credit and answer some of the most commonly asked questions. Read on and learn how you can collect your ERC credit today

The Employee Retention Credit (ERC) is a refundable tax credit created under the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The credit is aimed at helping employers who have been adversely affected by the coronavirus pandemic, to retain their employees. It covers up to 50% of qualified wages and health plan expenses, and can be claimed for wages paid from March 13, 2020, to December 31, 2021.

This credit is available to all employers, regardless of their size, if they have been impacted by a governmental order or have experienced a decrease in gross receipts. According to our research, over 95% of businesses qualify as “impacted,” and we have the expertise to help ensure that you receive the refund you are entitled to, even if other firms have told you otherwise.

Steps to Determine Your Eligibility.

Just 3 Easy Steps To Claim Your Credit

Claiming the ERC credit is surprisingly straightforward and easy. Here’s a breakdown of the three steps to claiming your credit:

Determine Eligibility

To begin, it is essential to determine whether your business meets the eligibility requirements for the Employee Retention Credit (ERC). The qualification criteria are relatively uncomplicated, and as long as your business has experienced the impact of the pandemic and fulfills the necessary conditions, you should be eligible for the credit.

Calculate The Credit

After confirming that your business satisfies the eligibility requirements, the next step is to calculate the amount of Employee Retention Credit (ERC) you can anticipate. In general, the credit corresponds to 50% of qualified wages, capped at $5,000 per employee per quarter, along with eligible health plan expenses. These calculations encompass wages and expenses incurred between March 13, 2020, and December 31, 2021. It’s worth noting that you can include wages paid to employees who did not work, as long as you met the eligibility criteria.

File For The Credit

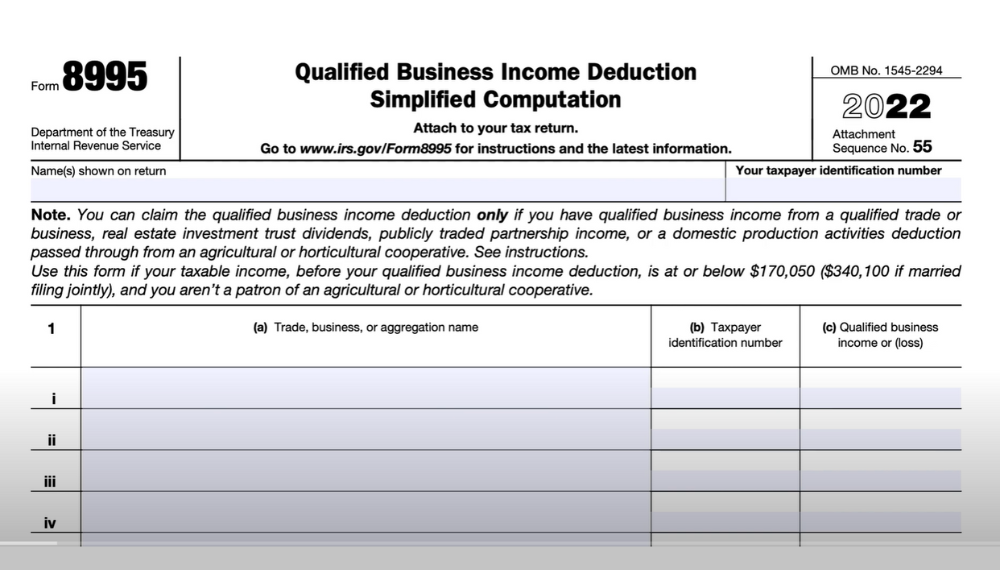

Lastly, you will proceed to file for the Employee Retention Credit (ERC). This involves completing Form 941, the Employer’s Quarterly Tax Return, with the necessary information accurately filled out. It is crucial to emphasize that the filing of Form 941 is a prerequisite for receiving the credit.

The Latest

ERC Filing Center Blog

Find Out How Much You Qualify For...

Since there are some nuances to the information above, it’s not surprising to hear many questions about the ERC credit. Some of the common questions we hear often include:

The Employee Retention Credit (ERC) is available to businesses of all sizes that have been affected by the coronavirus pandemic. This includes businesses impacted by government orders or experiencing a decline in gross receipts.

Eligible employers can receive a credit of up to $5,000 per employee per quarter. The credit is calculated as 50% of qualified wages and health plan expenses paid between March 13, 2020, and December 31, 2021.

It is important to note that businesses can still qualify for the Employee Retention Credit (ERC) even if they have received and had a Paycheck Protection Program (PPP) loan forgiven. However, it’s crucial to understand that the wages used to calculate the PPP loan cannot be used to calculate the ERC credit. In other words, if PPP loan funds were utilized to pay employee wages, those same wages cannot be used to determine the ERC credit.

If you have been informed that you do not qualify for the ERC, it is advisable not to dismiss the possibility outright. The regulations and qualifications surrounding the credit can be complex, so conducting your own research is essential. Once you have thoroughly reviewed the ERC guidelines and ascertained that your business meets the requirements, it is recommended to pursue the credit.

As with any government credit or incentive, it is important to be aware that the government may subject businesses utilizing the Employee Retention Credit (ERC) to closer scrutiny. The IRS has implemented stringent safeguards to detect potential instances of fraud. Therefore, it is crucial to ensure accurate calculations of the ERC and precise filings.

If someone else has already filed your ERC credit and you need to make modifications, you have the option to amend the filing. To do so, you can submit a new Form 941 and indicate that you are amending a previous filing by checking the appropriate box.

The Employee Retention Credit (ERC) presents an exceptional opportunity for businesses affected by the pandemic, offering a means to reduce payroll taxes and potentially receive a refund. It is crucial to thoroughly research the eligibility criteria to ensure your business qualifies for this remarkable opportunity and seize its benefits.

Collecting the ERC credit serves as a valuable source of tax relief during these challenging economic times. We trust that this guide has provided you with the necessary information and insights to help you reclaim your credit successfully. By following three simple steps, you can commence the process of collecting your ERC credit today and begin enjoying its advantages.