What is the Nonrefundable Portion of the ERC

Businesses face many challenges. To help them, there’s a support called the Employee Retention Credit. Think of it as a thank-you note for companies that don’t let go of their

Businesses face many challenges. To help them, there’s a support called the Employee Retention Credit. Think of it as a thank-you note for companies that don’t let go of their

Are you still waiting for your refund after applying for the Employee Retention Credit? So, how do I track my ERC refund? If you’re unsure about when or if it

If your business has kept its employees employed during 2020 and 2021, it’s likely that you qualify for the Employee Retention Credit or ERC. This credit can provide a substantial

In today’s business world, there’s a new problem that both employers and employees need to be careful about. These are employee retention credit scams. These scams take advantage of government

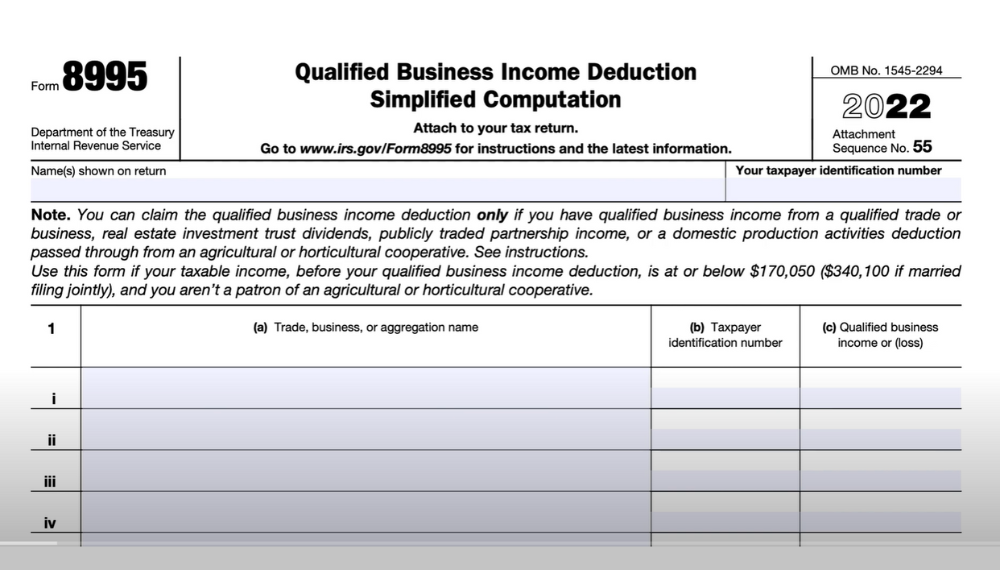

Are you a small business owner or a self-employed entrepreneur looking for ways to maximize your tax deductions and keep more of your hard-earned money? If so, you’re in luck!

In the world of business and finance, where every dollar counts and every decision has its consequences, the concept of employee retention credit has emerged as a powerful incentive for

Are you eagerly waiting for your ERC refund? Wondering when it will arrive or how to track its status? Look no further! Tracking the status of your ERC (Employee Retention

In the ever-evolving landscape of business and employment, one topic that consistently captures the attention of employers and human resources professionals is the Employee Retention Credit (ERC). This tax incentive,

In the complex realm of tax regulations, one particular question looms large for both employers and employees alike: Does the IRS audit the Employee Retention Credit? As businesses strive to

The Employee Retention Credit (ERC) is a valuable program designed to help small businesses retain their employees during periods of economic hardship, such as the COVID-19 pandemic. However, scammers have

During the COVID-19 pandemic, a significant number of small businesses turned to government loan programs to sustain their operations. As restrictions ease and businesses contemplate reopening, finding ways to retain

During these challenging times, businesses face the dual challenge of managing high staff turnover costs while navigating the complexities of the Employee Retention Credit (ERC) program. ERCs offer tax credits

The ERC refund process for the IRS may vary in terms of processing time depending on the complexity of the claim and the current volume of applications. Generally, straightforward refunds

The Employee Retention Credit (ERC) introduced through the CARES Act provides businesses in the United States with a valuable tool to reduce costs, cut taxes, and bring back employees during

Sign up to learn more about how ERC can benefit you and your business

PRIVACY POLICY | TERMS OF USE

All rights reserved | Copyright 2023 | ercfilingcenter.org