Are you a small business owner or a self-employed entrepreneur looking for ways to maximize your tax deductions and keep more of your hard-earned money? If so, you’re in luck! The IRS offers various tax incentives, and one of the most valuable deductions available is the Qualified Business Income (QBI) deduction. By claiming up to 20% of their qualified company income as a tax deduction, eligible taxpayers can dramatically lower their taxable income thanks to this effective tax relief. But how do you determine if you qualify and calculate the deduction accurately? This guide will explain the process and walk you through the ins and outs of Form 8995—the key to unlocking your QBI deduction potential and putting more money back into your pocket.

What is Qualified Business Income?

Qualified Business Income (QBI) refers to a tax term that has gained significant importance for small business owners and self-employed individuals since the implementation of the Tax Cuts and Jobs Act (TCJA) in 2017. This provision allows eligible pass-through income business owners to avail themselves of a valuable deduction of up to 20% of their share of qualifying income on their business taxes.

Essentially, the QBI deduction, also known as Section 199A, enables certain business entities, including sole proprietorships, partnerships, limited liability companies (LLCs), and S corporations, to reduce their taxable income by a substantial percentage. To claim this advantageous tax reduction, individuals must complete either Form 8995 or Form 8995-A and include it with their Form 1040 during the tax-filing season.

As such, the QBI deduction represents a powerful tool for maximizing tax benefits and promoting the growth of small businesses and entrepreneurial ventures.

What is Pass-Through Income?

Pass-through income refers to the portion of a business’s earnings that is not subject to business taxes but instead “passes through” to the owner’s individual income tax return.

This tax treatment allows certain business entities, such as sole proprietorships, partnerships, limited liability companies (LLCs), and S corporations, to avoid double taxation. Instead of being taxed at the business level, the profits and losses generated by the business are reported on the owners’ personal income tax returns.

For the tax year 2022, business owners meeting specific income thresholds can benefit from pass-through income treatment. Individuals with income below $170,050 (for those filing as single, head of household with a pass-through business, or married filing separately) or below $340,100 (for married couples filing jointly) before applying qualifying business income deductions are eligible.

While some limitations may apply to certain cases, owners qualifying for Form 8995 can take advantage of the pass-through income structure to optimize their tax situation and potentially reduce their overall tax liability.

How Pass-Through Income Affects Your Taxes

Pass-through income can have significant effects on an individual’s tax liability due to its unique tax treatment. Here are some ways pass-through income impacts your taxes:

Taxable Income

Pass-through income is included in the individual owner’s taxable income. This means that the profits generated by the business, along with any losses, are “passed through” to the owner’s personal tax return. As a result, the owner’s taxable income increases, which may potentially push them into a higher tax bracket.

Lower Tax Rate

One of the key advantages of pass-through income is that it is often taxed at the individual’s personal income tax rate, which can be lower than the corporate tax rate. This can lead to tax savings for some business owners.

Qualified Business Income Deduction (QBI)

The QBI deduction under the Tax Cuts and Jobs Act (TCJA) enables qualified pass-through business owners to deduct up to 20% of their qualifying business income from their taxable income. For those who qualify, this deduction can lead to significant tax savings.

Self-Employment Taxes

Owners of pass-through entities may be subject to self-employment taxes, which include Social Security and Medicare taxes. These taxes are generally paid by both employers and employees in traditional employment settings.

However, self-employed individuals are responsible for paying both portions, resulting in higher tax obligations.

Impact on Tax Credits and Deductions

Pass-through income can influence the eligibility and phase-out limits of certain tax credits and deductions, as these are often based on adjusted gross income (AGI).

State Taxes

The treatment of pass-through income can vary from state to state, and some states may have specific tax rules for pass-through entities, which can further affect overall tax liability.

Estimated Tax Payments

Business owners with pass-through income are responsible for making estimated tax payments throughout the year, as taxes are not withheld from their income like traditional employees. Failure to make sufficient estimated tax payments can result in penalties and interest.

What is Form 8995?

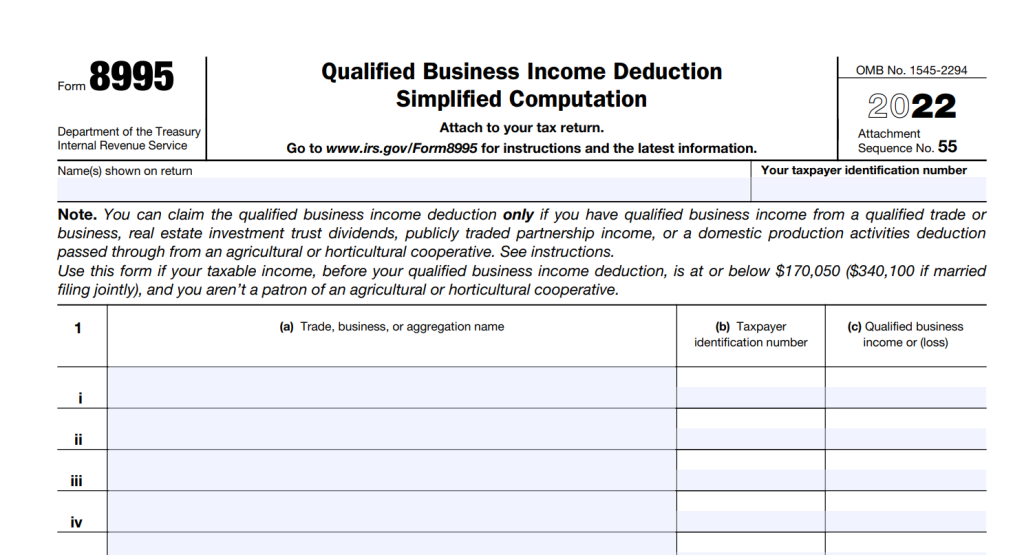

Image source

Form 8995, officially known as the “Qualified Business Income Deduction Simplified Computation,” is a tax form provided by the Internal Revenue Service (IRS) in the United States. It is an essential document for eligible taxpayers seeking to claim the Qualified Business Income (QBI) deduction—a valuable tax break introduced by the Tax Cuts and Jobs Act (TCJA) of 2017.

Form 8995 serves as a simplified computation method for calculating the QBI deduction for eligible taxpayers with total taxable income below certain thresholds. By completing this form, taxpayers can streamline the process of determining their deduction amount, optimizing their tax benefits while supporting the growth of small businesses and self-employment ventures.

It’s important to note that some taxpayers may not be eligible to use Form 8995 and may need to use the more comprehensive Form 8995-A, depending on their income and specific business circumstances.

As tax laws can be complex, consulting a tax professional is recommended to ensure accurate and compliant filing while maximizing the benefits of the QBI deduction.

Difference between Form 8995 and 8995-A

Form 8995

This form is titled “Qualified Business Income Deduction Simplified Computation.” It is designed for taxpayers with total taxable income below certain thresholds (currently $164,900 for single filers and $329,800 for married filing jointly in 2022). Form 8995 offers a simplified method for calculating the QBI deduction, making it more straightforward and easier to complete.

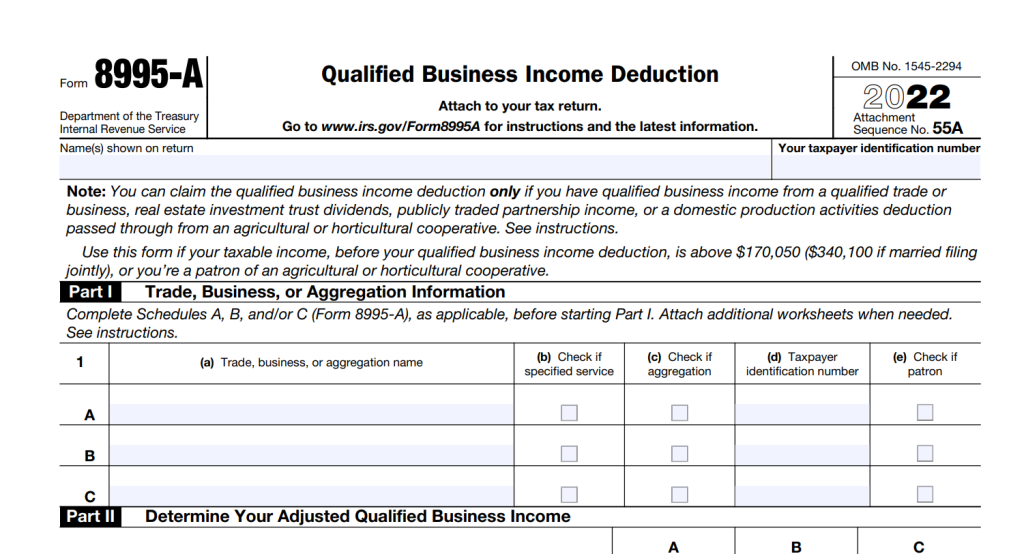

Form 8995-A

This form is titled “Qualified Business Income Deduction.” Taxpayers with total taxable income above the thresholds specified for Form 8995 must use Form 8995-A. It is a more comprehensive form that requires additional calculations and information, accommodating complex tax scenarios and limitations that may apply to higher-income taxpayers.

Overall, Form 8995 is for taxpayers with simpler tax situations and lower incomes, while Form 8995-A is for those with higher incomes or more intricate business structures, ensuring accurate and detailed calculations for the QBI deduction.

As with any tax-related matters, seeking guidance from a tax professional is advisable to ensure compliance and maximize available deductions.

Using Form 8995 to Calculate Your Qualified Business Income Deduction

Calculating your Qualified Business Income (QBI) deduction using Form 8995 involves several steps. Here’s a guide to help you through the process:

Check Eligibility

Ensure you meet the eligibility criteria for claiming the QBI deduction. Generally, it applies to pass-through businesses such as sole proprietorships, partnerships, LLCs, and S corporations.

Gather Information

Gather all the necessary information related to your business income and expenses. This includes your qualified business income, qualified REIT dividends, qualified publicly traded partnership income, and other relevant details.

Determine Taxable Income

Calculate your total taxable income for the tax year before applying for any deductions or credits.

Review Thresholds

Check if your total taxable income is below the threshold for using Form 8995. For the tax year 2022, the thresholds are $164,900 for single filers and $329,800 for married filing jointly. If your income exceeds these amounts, you’ll need to use Form 8995-A instead.

Fill Out Form 8995

If eligible, complete Form 8995. The form requires you to input the necessary income figures and apply the 20% deduction to arrive at your QBI deduction amount.

Qualified Business Income

Enter your qualified business income in Part I of Form 8995. This includes net income or loss generated by your eligible business activities.

REIT Dividends and PTP Income

If applicable, enter any qualified REIT dividends and qualified publicly traded partnership (PTP) income in Part II of the form.

Calculate the Deduction

Form 8995 will automatically calculate the deduction based on the information you provided. The result will be the amount you can deduct from your taxable income.

Transfer to Form 1040

After completing Form 8995, transfer the QBI deduction amount to your Form 1040 (U.S. Individual Income Tax Return) on the appropriate line. This will reduce your taxable income, potentially resulting in a lower tax liability.

File Your Taxes

Complete the rest of your tax return, including any other applicable deductions and credits, and file your taxes with the IRS.

Final Words

In conclusion, the Qualified Business Income (QBI) deduction, accessed through Form 8995 or Form 8995-A, offers valuable tax benefits for eligible business owners. By claiming up to 20% of qualified business income, you can reduce taxable income and potentially save significantly on taxes.

Whether using the simplified Form 8995 or the more comprehensive Form 8995-A, accuracy and compliance are crucial.

Seeking guidance from tax professionals or reliable software ensures you navigate the complexities with confidence, unlocking the full potential of this deduction and supporting your business growth while keeping more of your earnings.

Frequently Asked Questions (FAQs)

Who qualifies for the QBI deduction?

Sole proprietorships, partnerships, LLCs, and S corporations are eligible for the QBI deduction. However, there are income thresholds and other criteria that must be met.

Can I claim the QBI deduction if I have investment income or passive income?

Certain types of income, such as capital gains, dividends, and interest income, generally do not qualify for the QBI deduction. However, business income from eligible sources is eligible for the deduction.

Are there any limitations or phase-out rules for the QBI deduction?

Yes, high-income taxpayers and specified service trades or businesses (SSTBs) may face limitations or phase-outs for the QBI deduction.

Can I claim the QBI deduction for multiple businesses?

Yes, if you own multiple qualifying businesses, you can potentially claim the QBI deduction for each eligible business separately.

How do I report the QBI deduction on my tax return?

After calculating the deduction using either Form 8995 or Form 8995-A, you’ll transfer the deduction amount to your Form 1040 (U.S. Individual Income Tax Return) on the appropriate line.